Brussels – Now, the United States under Donald Trump is starting to get really scary. The concerns are about moves on cryptocurrencies, the strategic reserves they want to create, and the desire for a virtual currency linked to the dollar. It is a revolution with some risks, first and foremost of crypto-dollar-driven e-commerce. The topic is on the Eurogroup meeting agenda on Monday (March 10), where market developments and challenges for the single European currency are both present and growing.

“The new US administration has a very pro-cryptocurrency stance,” which is likely to translate into something negative for the eurozone and its currency, well-informed European sources admit. “In January, Trump issued an executive order aiming to ensure US leadership in digital assets in financial technology and to strengthen the international role of the dollar by promoting stable, legal, and legitimate dollar-backed currencies around the world.” A move that was “relevant to us, relevant to our payments landscape.”

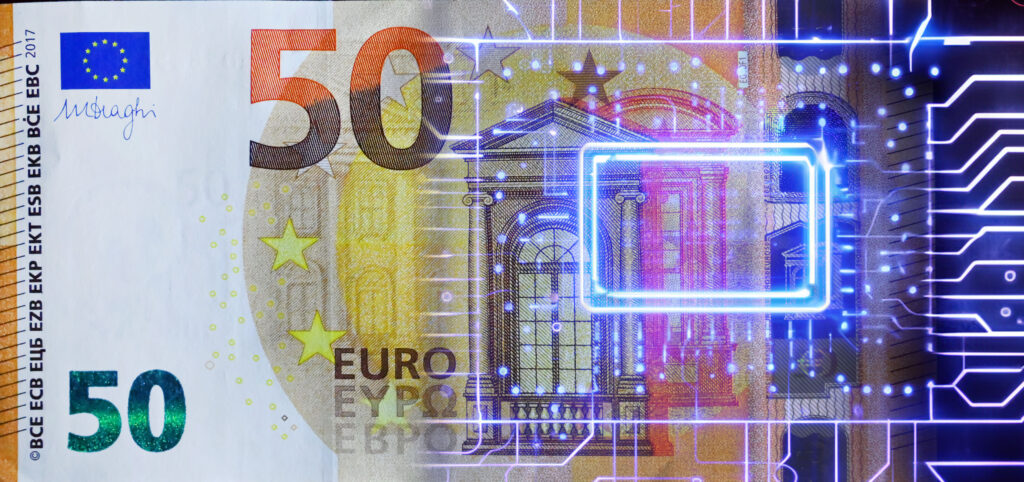

In light of the US moves, “one wants to prevent any initiative from having negative consequences on stability and sovereignty,” the same EU sources added. In Brussels and other capitals, there are fears that the spread of cryptocurrencies could jeopardize the authority of the European currency as a medium for transactions, thus weakening it in the markets and relegating it to more marginal roles in a world where online payments are increasingly the daily norm.

In this scenario, Trump’s approach raises additional questions. European sources admit that “if there is one thing we have learned in the last month and a half, it is that the new administration in Washington is ready to use all the sources of influence it has in negotiations to pressure other countries when it believes it is in the American interest.” Resorting to an increasing and determined use of digital currency for any transaction, starting with significant portals for commercial product sales and bookings.

The Eurogroup will become the forum for the European Commission and the European Central Bank to assess the overall situation, provide an overview of developments in the cryptocurrency markets, and begin to indicate how and in what ways US moves may affect Europe and its single currency.

What is certain is that the EU is behind with its digital euro: at least two years were necessary, starting from 2021, to reach the target, but the EU still does not have a tool in place. Trump’s rise may provide the push needed to avoid being overtaken by the virtual global market.

English version by the Translation Service of Withub![[foto: imagoeconomica, rielaborazione Eunews]](https://www.eunews.it/wp-content/uploads/2025/03/trump-criptovalute-750x375.png)