Brussels – European and U.S. stock market indexes are in free fall after Donald Trump’s tariffs announcements to all countries worldwide. The thud is particularly evident on Wall Street, which deteriorated further after a sharply declining opening: the Dow Jones lost 3.56 per cent, the NASDAQ 4.89 per cent, and the S&P 500 3.96 per cent. It’s no better on this side of the Atlantic: Frankfurt, Paris, London, and Milan’s Piazza Affari are all in the red within hours of the close.

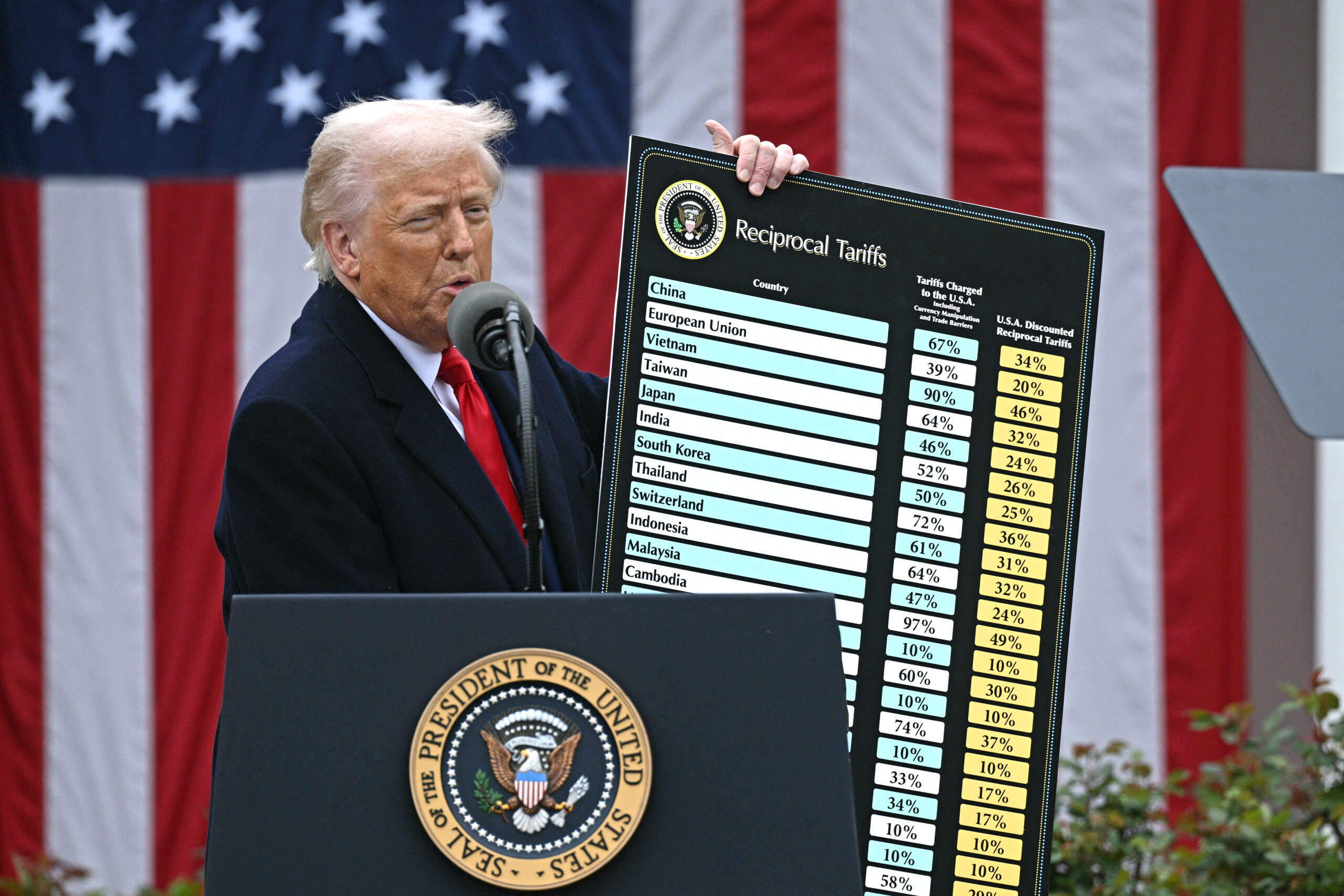

Last night’s (April 2) announcement was enough to anticipate the chaos that will spill over into international trade starting April 5, when the United States will apply a minimum level of reciprocal tariffs of 10 per cent to all trading partners. In Trump’s scheme, the ad hoc measures for the “naughtier” 60 will be triggered instead on April 9. Imports from the EU will be hit with duties at 20 per cent and from China at 54 per cent. Not to mention that for European steel, aluminium, and automotive, duties of 25 per cent have already come into effect.

Inevitably, by mid-day, Frankfurt’s DAX lost 2.21 per cent, Paris’ CAC 40 2.64 per cent, and Milan’s FTSE Mib index 2.24 per cent. Containing the crash was London’s FTSE, “pardoned” by Trump with the imposition of 10 per cent tariffs, losing 1.47 per cent. In Asia, the same script: Tokyo’s NIKKEI wakes up in the red by 3.3 per cent, Hong Kong down 2.14 per cent, and Shanghai down 0.8 per cent.

“To Wall Street we say, trust Donald Trump,” said White House spokeswoman Karoline Leavitt, commenting to CNN on the collapse of the markets, reiterating the tycoon’s narrative that “this is the beginning of the Golden Age, the United States will no longer be screwed over by other nations.”

It appears difficult, however, to trust a move that has left experts and economists around the world dumbfounded. Without going into the merits of the protectionist policy, but into the unhinged method, to say the least, with which the Trump administration has calculated the rates to be applied to the rest of the world (which will be imposed even on Heard Island and McDonald Islands, two volcanic islands in the Antarctic among the most remote places on Earth, completely uninhabited).

The White House allegedly calculated the U.S.’s tariffs simply by dividing each country’s trade surplus with Washington (the difference between how much they export to the U.S. and how much they import from the U.S.) by total exports. For example, regarding China, which was faced with a surplus of 291.9 billion and total exports to Washington worth 438.9 billion, the White House deducted that Beijing imposed 67 per cent tariffs on the US. And so, out of courtesy, it responded with half, 34 per cent. The same goes for the EU, accused by Trump of imposing 39 per cent tariffs on the United States and thus hit with reciprocal tariffs at 20 per cent. Moreover, European analysts complain that only the surplus of goods (not services) is considered in the calculation, and VAT is treated as a duty.

And so, Washington has imposed rates of 49 per cent on Cambodia, 48 per cent on Laos, and 46 per cent on Vietnam. Without taking into account – as notes The Guardian – that these countries’ trade surplus with the United States is not due to discrimination against U.S. products, but to the fact that they are relatively poor countries and therefore uninterested in the luxurious goods that the United States generally exports. On the other hand, they are countries that have become part of the global supply chain for large star-studded technology and apparel companies, such as Nike, Intel, and Apple.

And indeed, the hefty tariffs imposed on Vietnam have sent the U.S. footwear giant’s stock plummeting: if you unbundle the Dow Jones Industrial Average index, which tracks 30 of the largest U.S. companies, you find that Nike is the hardest hit, down more than 10 per cent.

English version by the Translation Service of Withub

![La presidente della Bce, Christine Lagarde [Francoforte, 6 marzo 2025]](https://www.eunews.it/wp-content/uploads/2025/03/lagarde-250306-350x250.png)