Brussels – The European Commission’s 2050 Energy Roadmap set out the long-term goal of reducing greenhouse gas emissions by 80-95%, compared to 1990 levels, by 2050. To achieve this ambitious target, Member States need to exploit synergies among policies and sectors as well as create market and regulatory frameworks able to increase investments in new low-emitting technologies and accelerate innovation. This will pave the way toward a virtuous cycle, which is also expected to create job opportunities and strengthen Europe’s competitiveness well beyond the energy sector.

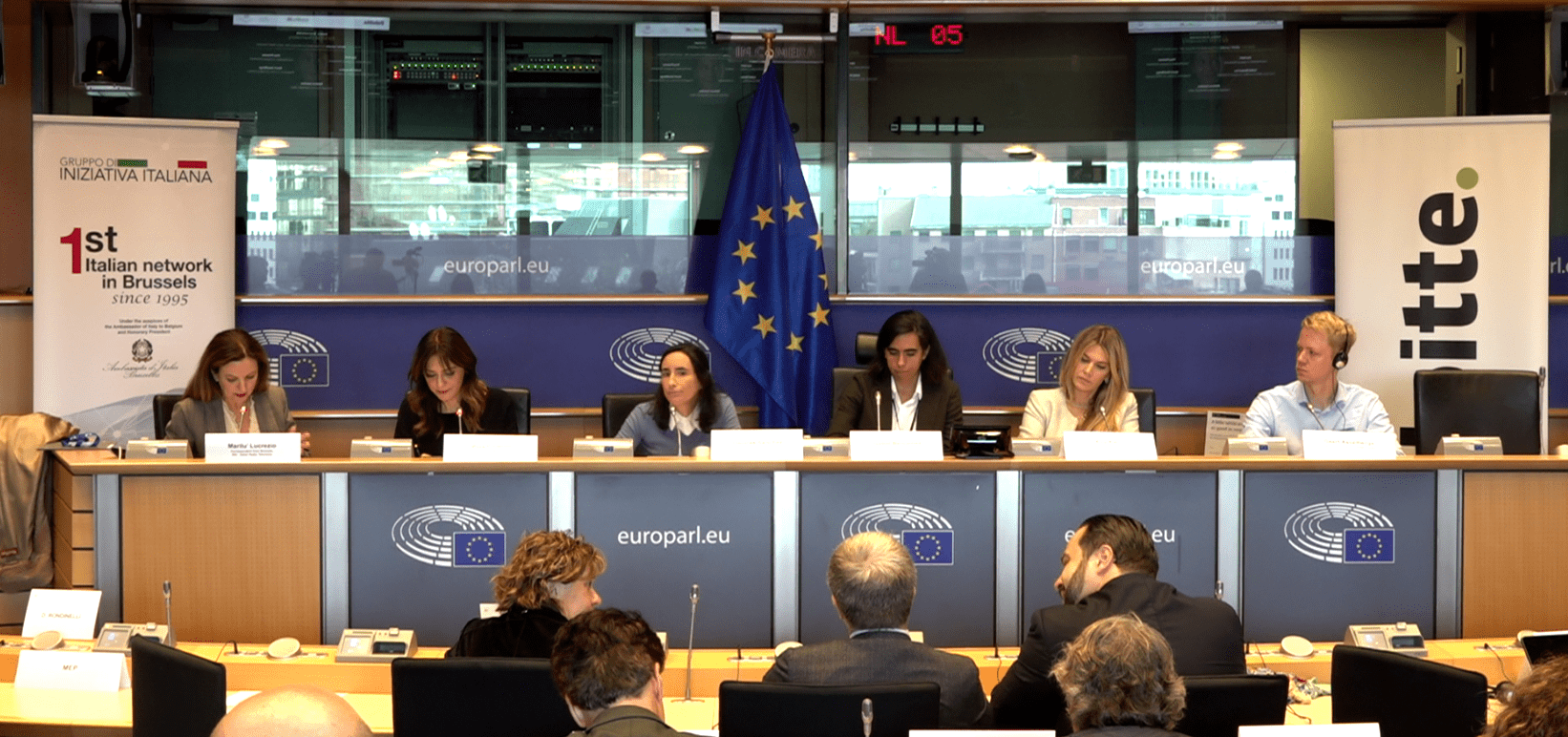

This is what emerged in a meeting between experts, industries and policy makers promoted by Deloitte at the European Parliament, in which the most advanced strategies to lead the transition towards the achievement of the Paris Agreement goal were showcased. During the event, Deloitte presented the key findings of its research on the most effective “low emission levers” to be used to achieve EU goals, followed by a discussion on the risks and opportunities for investors and the impact that the EU Energy Strategy is already having on businesses across the Union.

“When we talk competitiveness, diversity is good!” said MEP Adina Valean, Chair of the ENVI Committee of the European Parliament, while opening the conference. Diversity, in her words, “it is actually, what makes Europe strong on global markets. And we need to preserve this diversity in order to successfully transition to a fully integrated and sustainable European Economy. This is why we need tailored studies, like the ones you are presenting today, for the roadmap of each economy when it comes to energy production, transport or renovating buildings. To put it very plain, we must aim to keep industry in Europe and make it fully sustainable and then replicate this success model all around the world.”

Angelo Era, Energy Sector Leader of Deloitte Italy, confirmed that “meeting the 2050 targets is possible also with current technology”, and even that the medium-term objectives of 2030 “appear too conservative”. In this respect, the Deloitte Research proposes more challenging targets, in order to “achieve a greater push in technological innovation, and to build a more resilient roadmap, able to cope with possibly increasing pace in the economic growth.”

According to Era, “electric energy becomes the most relevant carrier in 2050, accounting for approximately 53% in Italy, 65% in Spain and 39% in Romania”.

Daniele Agostini, Head of Low Carbon and European Energy Policies of ENEL, has explained that “to fill the Paris Agreement ambition gap, the energy transition will have to be extensive, deep and fast. All scenarios show that electricity will have to play a much greater role than now”. Accelerating decarbonized electricity penetration in other sectors, such as transport and residential, “will not only produce climate change mitigation benefits”, he continued, “but also dramatically improve urban air quality”.

In this framework the Enel Group is “walking the talk” with a 2018-20 Industrial plan, focusing 57% of its 14+ billion euro on digitalized grids and 32% on RES. “A rapid and effective energy transition – warned Agostini – requires a stable and transparent regulatory framework, the timely development of digitalized infrastructure and an immediate utilization of available technologies, such as EVs and heat pumps”.

The academic point of view on the subject was put forward by Professor Colin Haslam of the Queen Mary University of London, who explained that “as global Gross Domestic Product expands so also do carbon emissions. It will be a significant challenge to decouple our dependency on global carbon emissions from economic growth”. According to the scholar, “Financial Institutions are factoring carbon risk into their portfolio decisions but there is the possibility that they will evacuate capital invested in carbon intensive business models leaving behind stranded assets”. However, he warned that “a disorganised exit of capital could have a negative impact on energy production and the supply of energy intensive processed materials”. He then continued by explaining that “financial institutions will need to invest capital into innovative solutions that reduce carbon dependency in energy intensive business models. The objective here is to decouple carbon emissions from energy intensive economic activity; especially when the outputs from these business models underwrite the viability of upstream business models that can secure leveraged financial returns and underwrite a significant proportion of debt, equity and market value accumulation”.

According to Tord Andersson, CEO and founder of the Swedish firm RVA Consulting, “Environment, Social and Governance (ESG) factors, such as carbon emissions, need to be fully integrated into investment decision making by financial institutions and managers to evaluate financial opportunities”. According to the expert it is then necessary to “support and modify the behaviour of financial institutions through incentives that steer their investment portfolios towards a low carbon and resource efficient economy”. Moreover, Andersson added, “ongoing developments in sustainability accounting and digital reporting by companies will help change our perception of investment performance through innovative software toolkits that combine financial with non-financial performance metrics”.

Later on, the Director of the World Business Council for Sustainable Development, Mario Abela, took the floor arguing that “relating sustainability information to a company’s business model and its value creation process is the best way to drive changes in decision-making towards better environmental and social outcomes”.

Nicolas de Jenlis, Director at Deloitte France, followed up on this theme explaining that “the need for conciseness of non-financial reports is commonly accepted. However, in several cases sound analysis requires more granular information. As an example, it makes no sense to compare CO2 emissions of two utility companies without a distribution versus production breakdown”. De Jenlis went on adding that “audit firms have dedicated sustainability teams, working on non-financial accounting and auditing. Those teams have the technical skills and can rely on Deloitte backbone regarding data confidentiality and security, internal control and governance experience”. According to the Deloitte professional, “transparency is one piece of the puzzle, but the puzzle is a non-sense without it. Whether you talking about Tax, CO2 quotas, capital requirements, etc. any public policy need sound and reliable metrics.”